Student Loan Stress: How a SaaS Solution Could Ease the Burden

Student loans are a reality for millions, but the stress of managing them—especially when debt collectors start calling—can feel overwhelming. Many borrowers report anxiety, panic attacks, and even harassment from relentless loan servicers. What if there was a centralized tool to help students take control of their loans, manage communication preferences, and find the best repayment strategies? Here’s how a hypothetical SaaS solution could ease this burden.

The Problem: Intrusive Communication and Financial Overwhelm

For many borrowers, student loans aren’t just a financial burden—they’re a source of daily stress. Debt collectors often call relentlessly, sometimes even contacting family members or associates. This intrusive communication can lead to anxiety, shame, and a feeling of helplessness. Many borrowers don’t know their rights (such as the ability to request cease-and-desist communications) or how to navigate repayment options effectively. The result? A cycle of avoidance, panic, and financial paralysis.

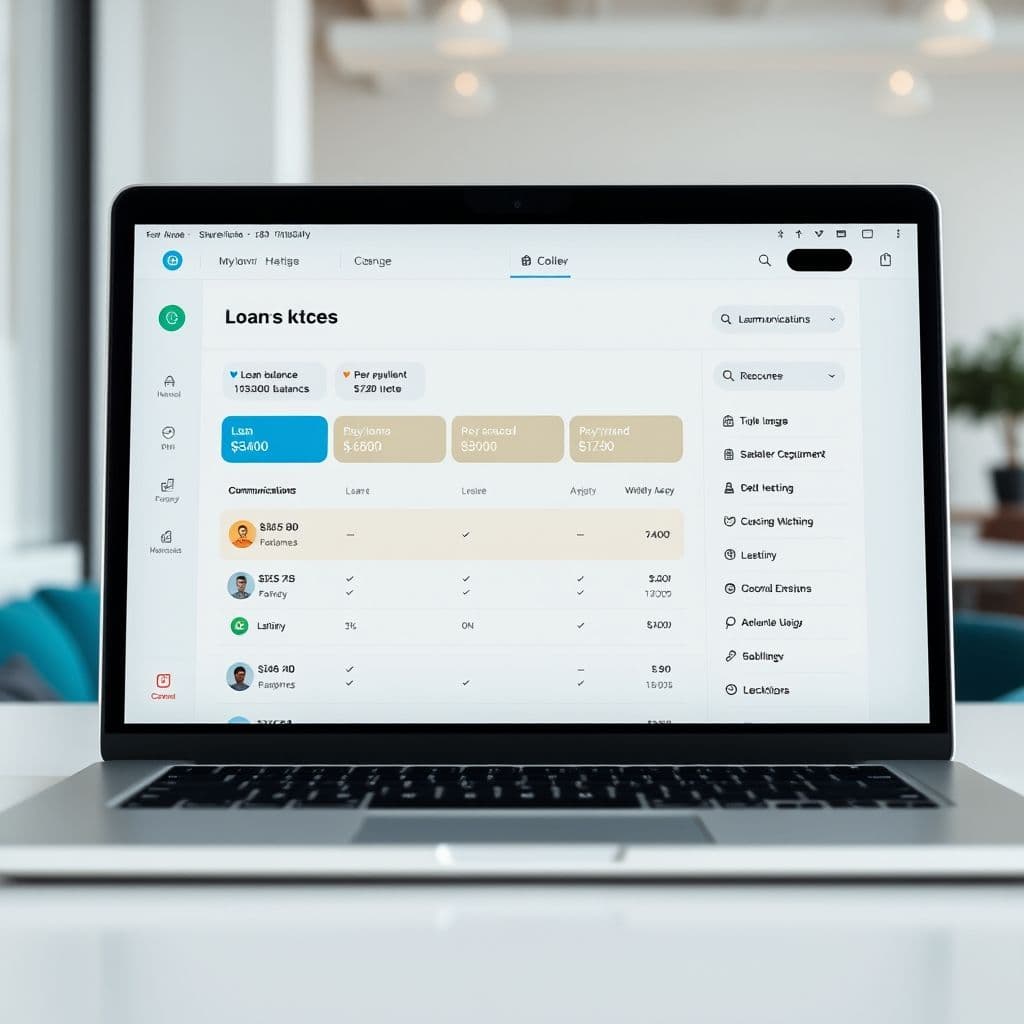

The SaaS Idea: A Centralized Loan Management Hub

Imagine a platform where borrowers could consolidate all their loan information, track repayment progress, and—most importantly—control how and when loan servicers contact them. This hypothetical SaaS tool could automate cease-and-desist requests, provide personalized repayment strategies, and even offer financial wellness tips tailored to the user’s situation. Key features might include: automated communication preferences, loan consolidation tracking, repayment plan comparisons, and alerts for important deadlines.

The platform could also integrate with financial institutions to provide real-time updates on loan statuses, reducing the need for stressful calls from collectors. Users could set boundaries—for example, allowing only email communications or limiting calls to specific times—while still staying informed about their obligations.

Potential Use Cases

This tool could be invaluable for recent graduates entering repayment, borrowers struggling with collector harassment, or even students considering loans who want to project future repayment scenarios. For example, a user could simulate how different repayment plans would affect their monthly budget, or automatically block calls from specific loan servicers during work hours. Financial advisors could also use the platform to guide clients through the often-confusing landscape of student debt.

Conclusion

Student loan stress doesn’t have to be a solo battle. While this SaaS idea is purely hypothetical, it highlights the need for better tools to manage loan communications and repayment strategies. By centralizing information and empowering borrowers to set boundaries, such a platform could reduce anxiety and help users regain control of their financial futures.

Frequently Asked Questions

- How could this SaaS tool help with debt collector harassment?

- The platform could automate cease-and-desist requests, limit communication to preferred channels (e.g., email only), and provide templates for legal responses to overly aggressive collectors.

- Would this tool replace loan servicers or financial advisors?

- No—it would act as a supplemental tool to help borrowers organize their loans, understand options, and reduce stress. Professional advice would still be recommended for complex cases.

- Is this idea technically feasible?

- Yes, though it would require integrations with loan servicers, secure data handling, and compliance with financial regulations. The core features (communication management, repayment tracking) are well within current tech capabilities.