Navigating Financial Crisis: A Hypothetical SaaS Solution for Debt Management After Job Loss

Losing a job is stressful enough, but when it's compounded by natural disasters and mounting debt, the situation can feel overwhelming. Many people find themselves unprepared to navigate the complex web of financial recovery options, from unemployment applications to debt management strategies. This article explores a hypothetical SaaS solution designed to simplify this process and provide much-needed guidance during financial crises.

The Problem: Debt and Financial Instability After Job Loss

When disaster strikes and jobs are lost, individuals are often left scrambling to manage their finances. The immediate concerns include paying bills, managing existing debt, and applying for assistance programs like unemployment or FEMA aid. The process is not only stressful but also confusing, with many people unaware of all the options available to them. Comments from social media highlight common suggestions: filing for bankruptcy, negotiating with creditors, or applying for government assistance. However, navigating these options requires time and knowledge that many don't have during a crisis.

Hypothetical SaaS Solution: A Centralized Financial Recovery Platform

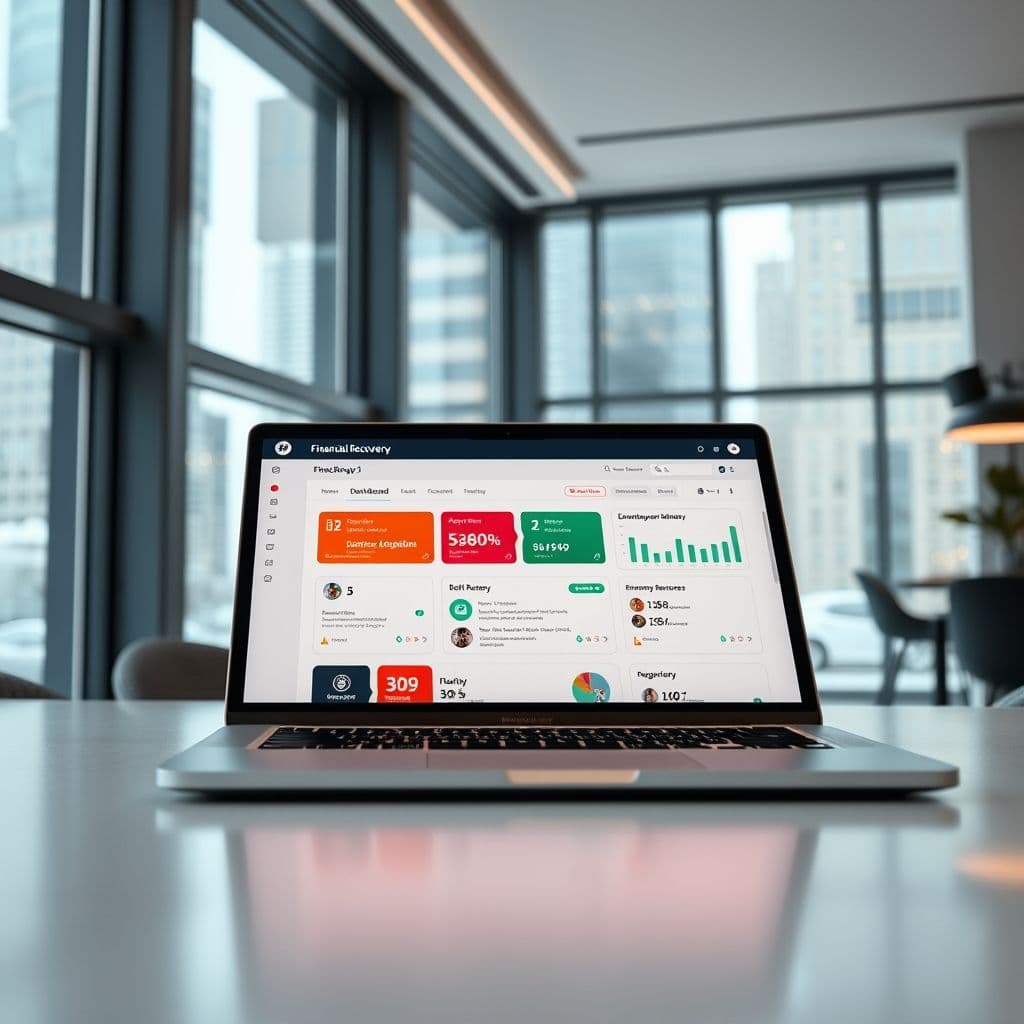

Imagine a platform that consolidates all the necessary tools for financial recovery into one intuitive dashboard. This hypothetical SaaS solution could offer personalized debt repayment strategies based on the user's specific situation, whether it's student loans, credit card debt, or medical bills. It could also automate the process of applying for unemployment benefits, FEMA assistance, and other relief programs, reducing the burden on the user.

Key features might include a budget planner that adjusts to reduced income, a debt snowball/avalanche calculator, and direct links to creditor negotiation tools. The platform could also provide educational resources on topics like bankruptcy options, credit score recovery, and emergency fund rebuilding. By integrating with existing financial institutions and government portals, the platform could streamline what is currently a fragmented and frustrating process.

Potential Use Cases and Benefits

This type of platform could be invaluable for individuals who suddenly find themselves unemployed due to disasters, as well as those facing long-term financial instability. For example, a user who lost their job in a wildfire could immediately access tailored advice on which relief programs they qualify for, how to prioritize their debt payments, and even templates for communicating with creditors. Small business owners affected by disasters could benefit from specialized modules addressing business loans and insurance claims.

The benefits extend beyond immediate crisis management. By helping users develop sustainable financial habits and rebuild their credit, the platform could contribute to long-term economic resilience. Community organizations and financial advisors might also use it as a tool to assist clients, making the recovery process more efficient and less isolating.

Conclusion

While this financial recovery platform is purely hypothetical at this stage, the need it addresses is very real. Natural disasters and economic downturns can leave people feeling helpless, but technology has the potential to provide clarity and direction during these challenging times. By centralizing resources and automating complex processes, a SaaS solution like this could make financial recovery more accessible to everyone.

Frequently Asked Questions

- How would this SaaS platform differ from existing budgeting apps?

- Unlike general budgeting apps, this hypothetical platform would focus specifically on crisis management, integrating disaster relief applications, creditor negotiation tools, and personalized debt strategies tailored to sudden income loss.

- What would be the biggest challenges in developing such a platform?

- Key challenges would include integrating with various government systems (which often have outdated tech), ensuring data security for sensitive financial information, and making the interface intuitive enough for users under significant stress.

- Could this platform help prevent people from needing to file for bankruptcy?

- While not a guarantee, by providing early access to alternative strategies like debt negotiation, income-based repayment plans, and emergency resources, the platform could potentially help some users avoid bankruptcy or make it a last resort rather than a first option.